Maximizing Your Retirement Savings: Top Investment Options for Future Security

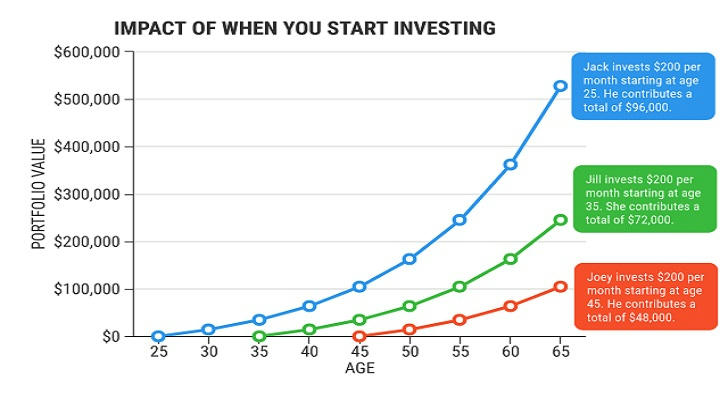

Maximizing retirement savings is crucial for long-term financial security, especially as fewer companies offer traditional pension plans. According to a 2020 report by the Employee Benefit Research Institute, only 25% of American workers have access to a defined benefit pension plan. The median retirement savings for households nearing retirement (ages 55-64) is just $12,000, far below what’s needed to maintain a comfortable lifestyle. Additionally, the power of compound interest significantly enhances savings growth. For instance, saving $300 monthly from age 25 could lead to over $1 million by age 65, assuming an 8% annual return. Conversely, delaying savings until age 45 would result in only around $400,000 with the same monthly contribution. By diversifying investments in 401(k)s, IRAs, and stocks, individuals can maximize returns and secure their financial independence, demonstrating the importance of starting early and strategically planning retirement savings.

Understanding Retirement Savings

Retirement planning is essential for achieving financial independence and ensuring a comfortable lifestyle in retirement. Without proper savings, you may struggle to maintain your desired standard of living or rely too heavily on Social Security, which often falls short. By saving early and consistently, you build a financial cushion that can cover various retirement needs like healthcare and everyday expenses. The power of compound interest further enhances your retirement savings, as it allows you to earn interest on both your initial investment and the accumulated interest. Starting early gives your money more time to grow exponentially, making regular contributions an effective strategy for securing your financial future.

Top Investment Options for Retirement

- 401(k) and Employer-Sponsored Plans

• What They Are: Employer-sponsored retirement plans that allow employees to contribute a portion of their pre-tax income for retirement.

• Benefits: Tax advantages (contributions are tax-deferred), employer matching, and the potential for growing savings without paying taxes until withdrawal. Contributing the maximum amount is crucial to take full advantage.

• Considerations: Choose between a traditional 401(k) (tax-deferred) or Roth 401(k) (tax-free withdrawals) based on your current and future tax situation.

- Individual Retirement Accounts (IRAs)

• Traditional vs. Roth IRA: Traditional IRAs offer tax-deferred growth with tax-deductible contributions, while Roth IRAs provide tax-free growth and withdrawals, but contributions are not tax-deductible.

• Why They Matter: Both offer unique benefits for long-term retirement savings, with the Roth IRA being ideal for those expecting to be in a higher tax bracket in retirement.

- Real Estate Investments

• Rental Properties: Investing in real estate can provide passive income, tax benefits, and potential long-term property value appreciation.

• REITs (Real Estate Investment Trusts): A more liquid way to invest in real estate, offering dividends and capital gains while diversifying your portfolio.

- Mutual Funds and ETFs

• Diversification Benefits: Both mutual funds and ETFs pool investments into a broad range of stocks, bonds, or other assets, spreading risk.

• Types to Consider: Target-date funds (automatic asset allocation), index funds (low-cost and broad market exposure), and dividend-focused funds (income-generating investments).

- Bonds and Fixed Income Securities

• Stable Returns: Bonds are low-risk investments that provide steady returns, making them an essential part of a diversified retirement portfolio.

• Types of Bonds: Government bonds (low-risk), corporate bonds (higher returns but slightly riskier), and municipal bonds (tax advantages).

- Stocks and Equities

• Growth Potential: Stocks offer high return potential over the long term, making them suitable for retirement accounts aimed at growth.

• Dividend Stocks: These stocks provide a regular income stream through dividends, making them particularly useful for generating passive income during retirement.

Diversifying Your Portfolio for Maximum Growth and Protection

•The Importance of Diversification: Diversification helps balance risk by spreading investments across various asset classes, such as stocks, bonds, and real estate. This strategy reduces the impact of volatility in any single investment, promoting more stable long-term growth.

•Asset Allocation Strategies: The optimal mix of investments depends on factors like age, risk tolerance, and financial goals. Younger investors might prioritize stocks for growth, while those nearing retirement may focus on safer investments like bonds and real estate to preserve capital.

• Rebalancing Your Portfolio: Over time, asset values change, causing your portfolio’s allocation to shift. Regularly reassessing and adjusting your investments ensures they align with your retirement goals, helping to protect your wealth while maintaining growth.

Strategies to Maximize Retirement Savings

• Start Early: The earlier you start saving, the more you benefit from compound interest. Consistently investing from a young age allows your money to grow exponentially over time, helping to secure a larger retirement fund.

• Contribute Regularly: Automating contributions to retirement accounts ensures consistency. By setting up automatic deposits, you can avoid the temptation to delay contributions and ensure steady growth of your retirement savings.

• Maximize Employer Contributions: Many employers offer matching contributions to your 401(k). Take full advantage of this benefit, as it’s essentially "free money" that boosts your savings and accelerates retirement growth.

• Catch-Up Contributions: Individuals over 50 can make catch-up contributions to their retirement accounts, allowing for higher contributions to accelerate savings as retirement approaches.

• Tax-Efficient Investing: Strategically use tax-deferred and tax-free accounts, such as IRAs and Roth IRAs, to minimize taxes on withdrawals and maximize the growth of your retirement savings.

Sarah, a 25-year-old marketing professional, started contributing 10% of her salary to her employer’s 401(k) plan from her first job. By taking full advantage of her employer’s 5% match, she ensured a total 15% contribution to her retirement savings. Over the next 30 years, with a consistent annual return of 7%, Sarah's initial yearly contribution of $5,000 grew to over $500,000 by the time she reached retirement. This illustrates how starting early and maximizing 401(k) contributions can lead to significant long-term growth.

Common Mistakes to Avoid When Saving for Retirement

Neglecting to Save Early Enough

Waiting too long to start saving for retirement can have serious consequences due to the lost benefits of compound interest. Even small contributions made early can grow exponentially over time. The longer you delay, the more you'll need to contribute later to make up for lost growth.Overlooking Tax Implications

Overlooking Tax Implications

Many people don’t fully understand the tax implications of their retirement savings strategies. Not paying attention to how different accounts (like 401(k)s, IRAs, or taxable accounts) are taxed can result in unnecessary tax liabilities, which can diminish retirement savings. Tax-efficient planning is essential to ensure you maximize your returns.

Taking Too Much or Too Little Risk

Finding the right balance of risk is crucial. Taking on too much risk can expose your savings to market volatility, while being too conservative can limit your potential for growth. It's important to regularly reassess your risk tolerance and adjust your asset allocation to match your retirement timeline and goals.

In conclusion, maximizing retirement savings involves selecting the best investment options, such as 401(k)s, IRAs, real estate, and stocks, while also employing strategies like diversification, regular contributions, and tax-efficient investing. By following these approaches, individuals can ensure steady growth and financial security in retirement. Now is the time to review your retirement plans, implement these strategies, and take proactive steps to secure a comfortable and financially stable future. This guide offers a comprehensive roadmap for anyone looking to build a solid financial foundation for retirement.